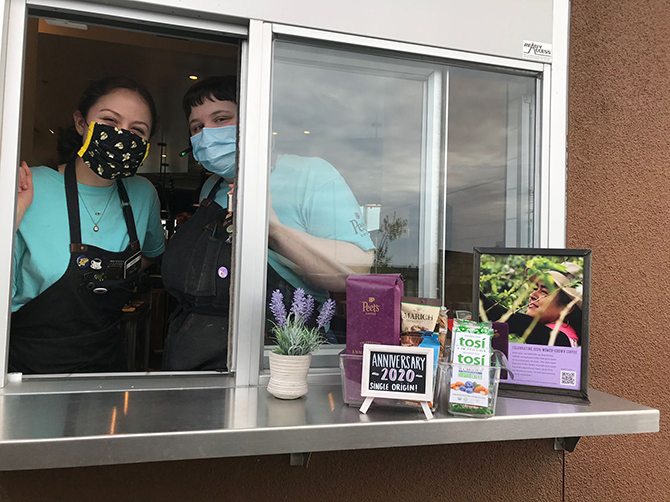

Coffee shops adapt to the new normal

Image courtesy of Peet’s Coffee/Melissa Voris-Knabe

As many countries, including the United Kingdom and the United States, have begun to lift stay-at-home/shelter-in-place orders, we are seeing more coffee shops, cafés and restaurants also starting to re-open or expand their operations — if they were active during the lockdown period. In fact, many coffee shops did remain open by shifting their operations and/or business models to adapt to the Covid-19 environment. Pursuant to this, the Specialty Coffee Association (SCA), in conjunction with Square Inc, has released a new report, The Specialty Coffee Industry During Covid-19.

The 2020 Square x SCA Coffee report outlines the current state of the specialty coffee industry (in the US — hopefully a UK- and/or EU-based report will be forthcoming) and includes insights into new trends and ways of doing business emerging as the Covid-19 pandemic continues to unfold. (Per the SCA, millions of anonymised transactions collected in coffee shops across the US were used to compile this report. All data is reflective of US Square coffee sellers as of May 2020.)

“Specialty coffee businesses across the country are evolving their efforts to serve communities and generate revenue during this unprecedented time. Amazingly, three in four Square coffee sellers have been able to continue operating during shelter-in-place, finding ways to adapt to their new circumstances,” said Peter Giuliano, the SCA’s chief research officer.

As specialty coffee businesses continue to evolve, the report reveals an increase in delivery and pickup/takeaway options (many coffeehouses require mobile orders or online orders only). The report also finds more cashless transactions taking place. Key findings from the report include:

- 5,380% increase in combined sales across curbside and/or pickup orders;

- 26% of coffee shops were cashless (did not process any cash transactions) by late April, up from 2% in early March;

- 109% increase in coffee subscription sales among coffee shops that have remained active during the pandemic;

- 400% increase in the number of Square coffee shops offering healthcare donations;

- 806% increase in healthcare donation sales (i.e., buying coffee for a healthcare worker) since shelter-in-place;

- A recent surge in grocery-style sales at Square coffee shops; the percentages below indicate the increase in number of merchants selling each item, followed by median price per item:

· Paper towels: 1,400% increase, USD $2.00

· Carton of almond milk: 1,100% increase, USD $5.00

· Family meal: 1,100% increase, USD $23.95

· A dozen eggs: 850% increase, USD $4.00

· Toilet paper: 711% increase, USD $1.50.

The number of coffee shops donating or selling healthcare-donation-related items is not surprising in the least – the coffee industry is a highly philanthropic one – our website has been filled with stories about coffee shops’ efforts to support frontline/essential workers since March.

Commenting on the report’s findings, Giuliano added, “This shows tremendous resilience and creativity, from curbside coffee pickup to grocery store-style sales, home delivery to expanded eCommerce. These trends seem to represent more than a brief moment in time — they likely indicate a greater transformation of the specialty coffee industry and a new way that coffee shops work within the communities they serve.”

Coincidently, in T&CTJ’s June issue, Emily McIntyre, in her “Unfiltered” column, discusses being “resilient in a crisis.” In the piece, she quotes Verne Harnish, author of Scaling Up, whose webinar she attended mid-April, who said, “If you are practicing the same business model as thirty days ago — you will fail.”

The ability of so many coffee shops, in the US and globally, to not only acclimate quickly to operating amid the Covid-19 crisis, but also adapt their business models to survive, shows their strength and resiliency, which bodes well for the future of the specialty coffee industry.