A growing trend: plantable packaging

Image: Four Stages Tea and Herbals

Spring is in full bloom, and apparently, so is the plantable packaging market. A new report from global market research firm, Future Market Insights (FMI), projects the plantable packaging market size to be valued at USS $120 million in 2023 and to rise to USD $340 million by 2033. Sales of plantable packaging, per FMI, are expected to grow at a CAGR of 11% during the forecast period.

Plantable packaging, that is, packaging created from natural and biodegradable materials, is an emerging market – still small within the coffee and industries but expanding – that FMI believes has the potential to grow rapidly in the coming years due to its sustainable and environmentally friendly qualities.

As people become more aware of the environmental impact of plastic waste, there is a greater demand for sustainable packaging alternatives. Plantable packaging is not just a sustainable solution, but it also has other advantages in addition to biodegradability, such as durability and moisture resistance.

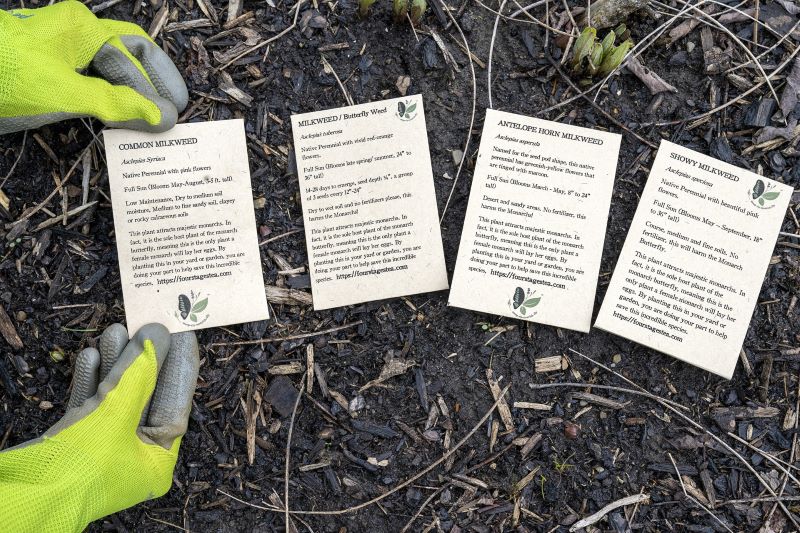

Although, the amount of coffee and tea packaging that is ‘plantable’ is relatively small, we are seeing more compostable and biodegradable packaging and single serve capsules/pods enter the market each year. Some companies are fully committing to the ‘plantable’ aspect, such as Four Stages Tea and Herbals, a company that offers all organic and fair-trade loose-leaf functional tea blends and which proceeds go to saving the monarch butterfly, which is on the verge of extinction. Four Stages has announced that it is launching plantable packaging that has milkweed seeds and nectar plants infused inside (see T&CTJ’s July/August 2023 issue for a story on Four Stages Tea and Herbals).

The regulatory push for sustainable packaging enhances plantable packaging’s appeal. As the report notes, governments around the world are implementing measures to decrease plastic waste and encourage sustainable packaging. The European Union (EU), for example, has set ambitious targets to eliminate plastic waste and promote the use of environmentally friendly packaging materials. The EU Circular Economy Action Plan, which aims to make the European economy more sustainable and circular, is one method Europe uses to promote plantable packaging options. Furthermore, several EU countries have enacted legislation and measures to limit plastic waste and encourage sustainable packaging options.

As part of its efforts towards sustainable development, India is actively promoting plantable packaging options. FMI reports that the government has implemented several initiatives and legislation to encourage the use of environmentally friendly packaging materials.

Within North America, several programs have been implemented to encourage the usage and adoption of plantable packaging solutions, such as the Sustainable Packaging Coalition (SPC), a membership-based collaborative that strives to create a more sustainable packaging sector. The SPC has created a set of sustainable packaging guidelines, which include the use of plant-based materials and compostable packaging. It also provides companies with tools and resources to help them implement sustainable packaging solutions, such as plantable packaging.

Plantable packaging also provides a unique value proposition to clients because it not only functions as a packaging material but also doubles as a way to produce plants. This packaging technology can help businesses stand out in a congested market and attract customers who want something different. As with all packaging, plantable varieties can be customized with various forms, colours, and designs.

While there are many upsides to plantable packaging, FMI’s report reveals some current disadvantages that must be considered before any investments are made. For example, the limited market size — while the plantable packaging market is expanding, it remains modest in comparison to other packaging materials. In the short term, this may limit the potential for high returns on investment. Additionally, plantable packaging is currently more expensive than standard packaging materials, making it less competitive in price-sensitive applications. Furthermore, scalability might be a challenging aspect for businesses that rely on natural materials as they can be altered by weather or other external factors.

Investment in the plantable packaging industry can provide significant opportunities for growth and sustainability. However, as FMI’s report advises, comprehensive study and due diligence are required to examine the product’s market potential, competitive landscape, and environmental impact, among other things. Yet, as governments ramp up their efforts to reduce packaging waste and consumers demand more sustainable options, plantable packaging is one to strongly consider.

- Vanessa L Facenda, editor, Tea & Coffee Trade Journal.

Keep in touch via email: [email protected] Twitter: @TCTradeJournal or LinkedIn: Tea & Coffee Trade Journal